Streaming giant Netflix Inc. is actively exploring a potential acquisition of Warner Bros. Discovery, a move that could reshape the global entertainment landscape. The company has reportedly engaged financial advisory firm Moelis & Co. to assess the viability of a deal and is currently reviewing Warner Bros. Discovery's financial data.

The development signals a significant escalation in the ongoing sale discussions surrounding the legacy media company, which owns a vast library of valuable content. News of Netflix's interest has already sent ripples through the market, with shares of both companies reacting positively to the potential consolidation.

Key Takeaways

- Netflix has hired Moelis & Co. to advise on a potential acquisition of Warner Bros. Discovery.

- The streaming service is currently conducting due diligence by reviewing Warner's financial information.

- Warner Bros. Discovery has already rejected three lower bids from competitor Paramount Skydance.

- A successful deal would give Netflix control over major franchises like Harry Potter, DC Comics, and Game of Thrones.

- Both companies' stock prices rose following the reports of Netflix's interest.

A High-Stakes Bidding War Emerges

Netflix's entry into the fray intensifies an already competitive situation. Warner Bros. Discovery confirmed on October 21 that it was evaluating several strategic options, including the sale of its studio and streaming assets. This announcement opened the door for potential suitors to make their move.

Before Netflix's interest became public, Paramount Skydance, led by David Ellison, had been a prominent bidder. However, Warner Bros. Discovery rejected three separate offers from Paramount, signaling that its board is holding out for a premium valuation. Other potential bidders, including Comcast, have also been mentioned in connection with a possible deal.

A Content Powerhouse at Stake

An acquisition of Warner Bros. Discovery is highly coveted due to its extensive and iconic intellectual property. The company's portfolio includes the Warner Bros. film and television studios, the HBO Max streaming service, and globally recognized franchises such as the DC Universe, Harry Potter's Wizarding World, and the world of Game of Thrones.

For Netflix, acquiring these assets would represent a monumental step in solidifying its market dominance. While the company has built a formidable library of original content, integrating these established franchises would provide a significant competitive advantage against rivals like Disney+, Amazon Prime Video, and Apple TV+.

Netflix's Strategic Calculus

The potential bid aligns with recent statements from Netflix's leadership. Co-CEO Ted Sarandos noted earlier this month that while the company does not depend on acquisitions for growth, it remains open to opportunities that add substantial value and strong content to its platform. He specifically clarified that Netflix has no interest in acquiring traditional cable networks, preferring to focus its resources on streaming and technology.

"We don’t need acquisitions to grow," Sarandos stated, but added the company will "consider opportunities that add strong content."

This potential move is seen as a direct play for Warner's prized content library. Such a deal would not only expand Netflix's offerings but also remove a major competitor from the market, consolidating a significant portion of the streaming landscape under one roof. The talks are still in an early phase, and no formal offer has been made by Netflix at this time.

Market Reaction and Stock Performance

Following the news, Warner Bros. Discovery shares (WBD) climbed over 4% in late trading on Friday. Netflix (NFLX) shares also saw a positive bump of about 1.5%, building on momentum from a recently announced 10-for-1 stock split.

Warner Bros. Sets a High Bar

Inside Warner Bros. Discovery, the situation is being closely watched. CEO David Zaslav has made it clear that any potential buyer will need to present a compelling offer. During a recent town hall meeting with employees, Zaslav emphasized that the company's board would demand a high price for a sale, a position reinforced by its rejection of Paramount's earlier bids.

The company is not without alternatives. If a satisfactory offer does not materialize, Warner Bros. Discovery has a standing plan to split into two separate entities, Warner Bros. and Discovery Global, a restructuring scheduled for next year. This provides the company with leverage in negotiations, as it is not forced into a sale.

Meanwhile, the uncertainty has created a tense atmosphere among employees. Reports from within the company describe a mix of anxiety and resignation, as staff who have weathered previous corporate mergers and sales await the outcome. Memos encouraging a "business-as-usual" approach have been circulated, but discussions about job security are reportedly common.

Wall Street's View on the Companies

Analysts on Wall Street maintain a cautiously optimistic outlook on both companies, though their valuations tell different stories.

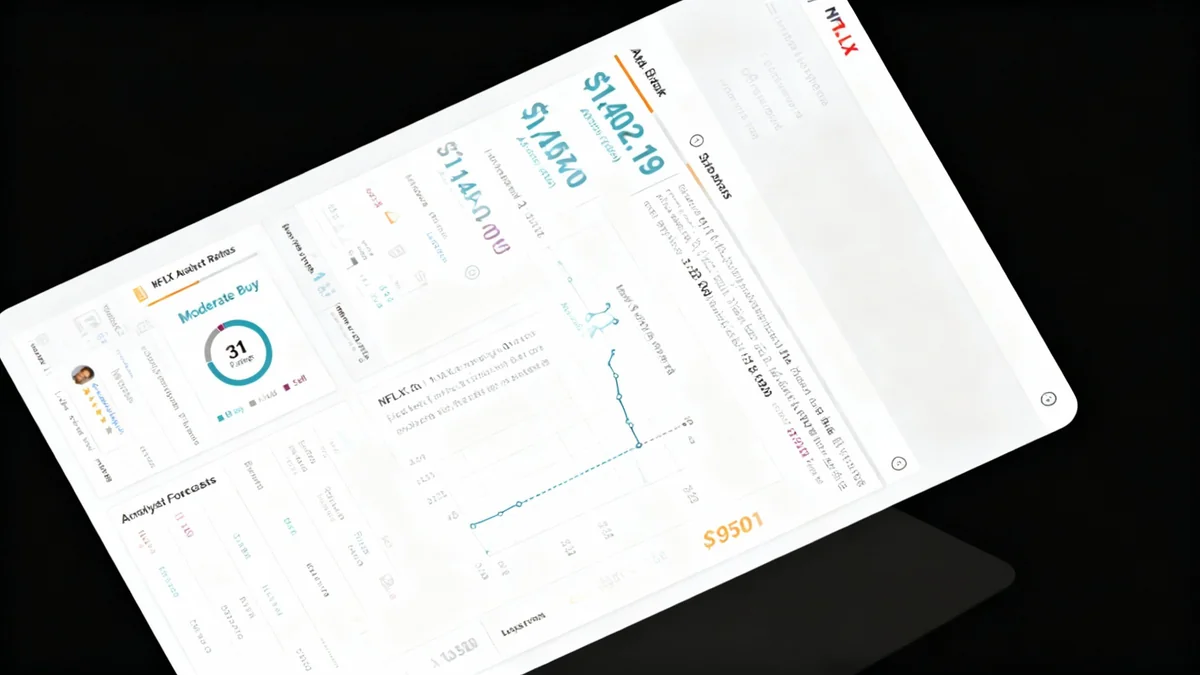

Netflix (NFLX)

- Consensus Rating: Moderate Buy

- Analyst Breakdown: Based on 31 ratings, with 24 Buys, 6 Holds, and 1 Sell.

- Average Price Target: $1,402.19, implying a potential upside of 28.76% from current levels.

Warner Bros. Discovery (WBD)

- Consensus Rating: Moderate Buy

- Analyst Breakdown: Based on 18 ratings, with 8 Buys and 10 Holds.

- Average Price Target: $20.75. Following a 162.7% rally over the past year, this target suggests a potential downside risk of 7.82%.

The coming weeks will be critical in determining whether Netflix proceeds with a formal bid and if Warner Bros. Discovery's board finds the offer compelling enough to alter the future of one of Hollywood's most storied companies.