The quantum computing sector has attracted significant investor interest over the past year, fueled by technological advancements and major capital commitments. Amidst this excitement, an investor analysis offers a detailed comparison of two prominent companies, IonQ (NYSE:IONQ) and Rigetti Computing (NASDAQ:RGTI), reaching different conclusions for each.

While both companies have seen their stock prices surge, the analysis highlights IonQ's strategic acquisitions and strong partnerships as reasons for a cautious buy, while expressing skepticism about Rigetti's current valuation despite its impressive market performance.

Key Takeaways

- Quantum computing stocks have experienced substantial gains, driven by technological breakthroughs and increased investment in the sector.

- An investor known as Hunting Alpha has initiated a position in IonQ (IONQ), citing its strategic acquisitions and strong customer base.

- The same investor remains neutral on Rigetti Computing (RGTI), expressing concerns over its valuation and lack of consistent revenue growth.

- Both IONQ and RGTI have achieved significant technical milestones, but they remain in the research and development phase without profitability.

The Growing Quantum Computing Market

Investor enthusiasm for quantum computing has intensified recently. A key moment occurred in December 2024 when Alphabet announced its Willow chip performed a calculation in minutes that would take a traditional supercomputer an estimated 10 septillion years. This demonstrated the immense potential of the technology.

Further boosting confidence, J.P. Morgan revealed plans to direct $1.5 trillion toward sectors critical to U.S. national security, with quantum computing being a named area of focus. This signals strong institutional belief in the industry's future.

Market Projections

A report from McKinsey projects that the quantum computing industry could expand to a $72 billion market by 2035, underscoring the long-term growth potential that is attracting investors.

However, investing in this space is not without risk. Most quantum companies are still in the early stages of development and have not yet generated profits. Some technology leaders have questioned the near-term practical applications, making these investments speculative.

Analysis of IonQ (IONQ)

IonQ has been a focal point for investors due to its trapped-ion technology and consistent progress. The company's stock price reflects this optimism, having increased by 403% over the last 12 months.

Technical and Strategic Progress

Earlier this week, IonQ announced that its fifth-generation system, IonQ Temp, achieved an Algorithmic Qubit (#AQ) count of 64. The company stated this was accomplished three months ahead of schedule and provides a computational space 36 quadrillion times larger than competing systems from IBM.

The company also recently finalized its acquisition of Vector Atomic. This move brings expertise in quantum sensing for positioning and navigation systems, broadening IonQ's technological capabilities. The company is also working with government agencies, having signed a Memorandum of Understanding with the U.S. Department of Energy to develop quantum solutions for space and cybersecurity.

High-Profile Partnerships

IonQ has established a strong network of partners and customers, including major technology companies like Nvidia, Google Cloud, and Microsoft Azure. These collaborations provide validation and potential pathways to commercialization.

An Investor's Bullish Turn

Investor Hunting Alpha, who was previously bearish on the stock, recently changed their stance. They have now taken a small position in the company, citing several key factors.

"I have succumbed to the FOMO and have bought a small position in IONQ," the investor stated, explaining their decision was based on the company's strategic direction.

The analysis points to IonQ's "reasonably priced" acquisitions as a primary driver of growth. The appointment of Inder Singh, a former Cisco executive with a strong M&A background, as CFO further strengthens confidence in this strategy. While these activities have led to growing EBITDA losses, a $1 billion equity raise in July provides IonQ with significant cash reserves.

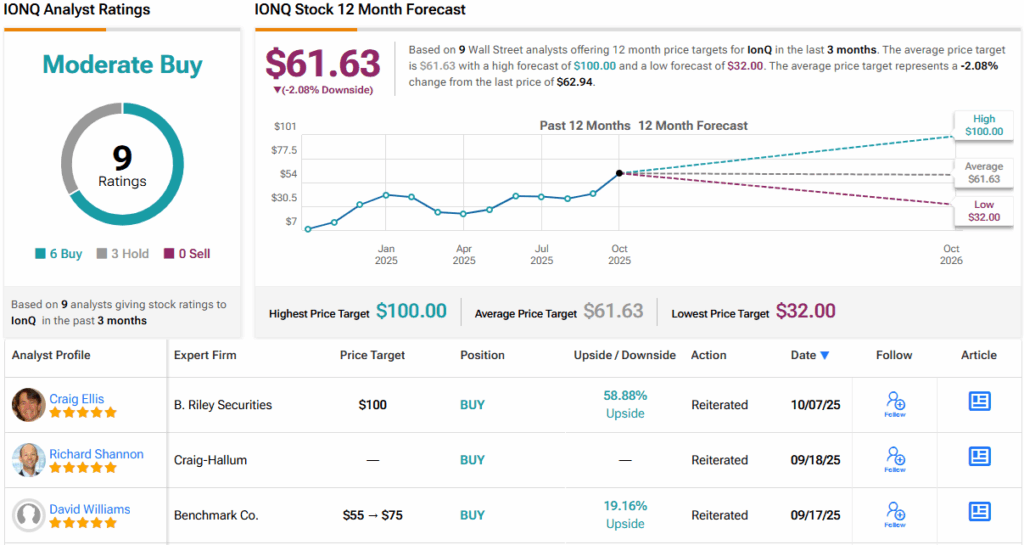

Wall Street analysts currently have a Moderate Buy consensus rating on IONQ, based on 6 Buy and 3 Hold recommendations. However, the average price target of $61.63 suggests a potential 2% downside, indicating the stock may have outpaced near-term expectations.

Analysis of Rigetti Computing (NASDAQ:RGTI)

Rigetti Computing has seen one of the most dramatic increases in the sector, with its stock price soaring by an astonishing 4,777% over the past year. This performance is backed by tangible business developments and technical advancements.

Recent Contracts and Technology Updates

In recent months, Rigetti secured contracts for the sale of two 9-qubit quantum computing systems for $5.7 million. It also won a three-year, $5.8 million contract from the Air Force Research Laboratory (AFRL) to work on superconducting quantum networking.

On the technology front, Rigetti announced its modular 36-qubit system achieved a median two-qubit gate fidelity of 99.5%. This represents a significant reduction in error rates. The company plans to launch this system on August 15, 2025, and aims to scale the architecture to a system with over 100 qubits by the end of 2025.

Valuation Concerns and Investor Caution

Despite the positive momentum, Hunting Alpha remains on the sidelines with a Hold rating for RGTI. The investor's primary concern is the company's valuation and fundamental growth prospects.

"I cannot bring myself to act on that impulse, as my rational mind struggles to see a single good reason for bullish fundamental growth prospects," the investor wrote.

The analysis notes that Rigetti has not yet shown "meaningful" revenue growth. Even the company's CEO, Subodh Kulkarni, has stated it is too early to discuss sales growth seriously. There are also concerns that recent system sales might be one-off orders rather than signs of recurring demand.

Furthermore, the investor highlights the risk of future share dilution. They argue that the current market valuation of $3.553 billion implies the market is pricing in significant future equity infusions, far above the current equity balance of $553 million.

Analysts on Wall Street hold a Strong Buy consensus rating on RGTI, with 6 Buy ratings and 1 Hold. Yet, similar to IONQ, the average price target of $28.10 implies a significant 39% downside from its current trading level, suggesting a major disconnect between the stock's price and analyst valuations.