Corporate earnings for the S&P 500 are surging to new heights, driven by exceptional performance from a handful of technology leaders. The index's forward earnings per share have reached a record high, signaling strong momentum for the stock market as the year comes to a close.

This growth is largely attributed to the so-called "Magnificent 7" technology companies, whose advancements in artificial intelligence are fueling unprecedented demand for cloud computing services. This trend is reshaping profit expectations and pushing stock valuations to new peaks.

Key Takeaways

- S&P 500 forward earnings per share rose to a record high of $299.61, nearing the $300 milestone.

- The "Magnificent 7" technology companies are the primary drivers of this earnings growth.

- Strong demand for AI is boosting cloud computing revenue, as seen in Amazon's latest earnings report.

- Analysts project forward earnings could reach $350 per share by the end of 2026.

Tech Titans Lead the Market Charge

The overall health of the S&P 500 is increasingly tied to the performance of its largest constituents. A select group of technology companies has consistently surpassed earnings expectations, creating a significant impact on the entire index.

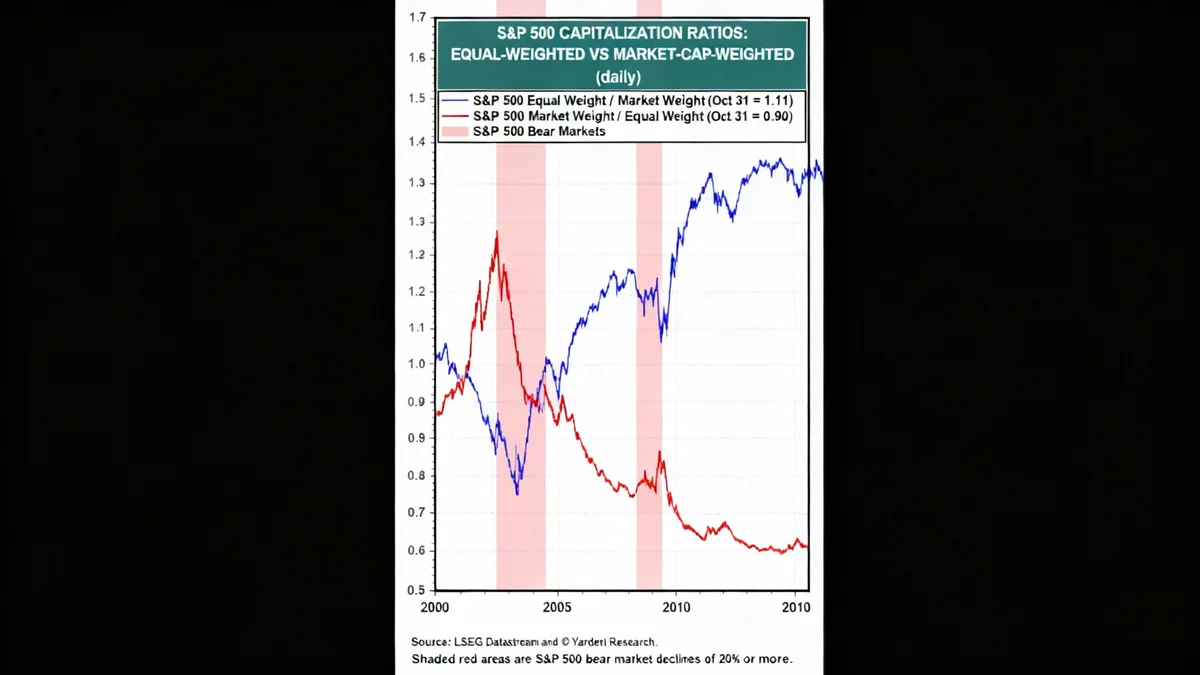

This concentration of success has led to a noticeable divergence in market performance. The standard market-capitalization-weighted S&P 500 index, where larger companies have more influence, continues to outperform its equal-weight counterpart. This indicates that the record-setting rally is not broad-based but is instead powered by these few dominant players.

Understanding the Magnificent 7

The "Magnificent 7" is an informal name for a group of seven of the largest and most influential technology companies in the U.S. stock market. While the exact list can vary slightly, it generally includes companies like Amazon, Apple, Google (Alphabet), Meta, Microsoft, Nvidia, and Tesla. Their massive market capitalizations mean their performance has an outsized effect on indexes like the S&P 500.

Amazon's Cloud Business Highlights AI Boom

A recent earnings report from Amazon provided a clear example of this trend. The company's stock price saw a significant jump after it revealed impressive growth in its cloud computing division, Amazon Web Services (AWS).

AWS revenue increased by 20% in the third quarter, a growth rate not seen since 2022. Amazon CEO Andy Jassy directly linked this acceleration to strong demand for both artificial intelligence applications and core cloud infrastructure.

"[AWS is] growing at a pace we haven't seen since 2022," Jassy noted, highlighting that AI and core infrastructure are experiencing "strong" demand.

This performance confirms a critical market dynamic: the real profits from the AI revolution may not come from the AI software itself, but from providing the immense computing power required to run it.

AI's Thirst for Computing Power

The rise of artificial intelligence is not just a software story; it's a hardware and infrastructure story. Sophisticated AI models, particularly large language models (LLMs), require vast amounts of data processing capacity, which is supplied by cloud providers like AWS, Microsoft Azure, and Google Cloud.

Think of it as a new digital gold rush. While many companies are developing AI applications (the prospectors), the big cloud companies are selling the essential picks and shovels—the server space, processing power, and data storage needed for any AI venture to succeed.

The Unending Digital Revolution

The current AI boom is the latest phase of the Digital Revolution that began in the 1960s. The core principle has always been to process more data, faster and cheaper. With a seemingly infinite supply of data in the world, the demand for processing power is expected to continue its upward trajectory indefinitely.

This creates a powerful and potentially long-lasting revenue stream for the tech giants that own the world's largest data centers. Every new AI startup and every established company integrating AI into its operations becomes a customer for their cloud services.

Earnings Projections and Market Outlook

The financial markets are taking notice of this powerful trend. The continuous rise in corporate profits has pushed the S&P 500's forward earnings per share (EPS) to a new record of $299.61 during the last week of October. This figure represents the estimated earnings of the index's companies over the next 12 months.

The number is tantalizingly close to the $300 threshold that many analysts predicted for the end of the year. Given the current momentum, the final year-end figure is likely to exceed that target.

Looking further ahead, some forecasts are even more optimistic. Based on the sustained demand for digital infrastructure and the productivity gains promised by AI, projections suggest that S&P 500 forward earnings could climb to $350 per share by the end of 2026. This outlook is fueling what some are calling a new "Roaring 2020s" scenario for the stock market.

What This Means for Investors

For investors, this trend highlights the importance of the technology sector as a driver of overall market returns. The stock market is currently pricing in the expectation that AI will deliver significant productivity and earnings growth for the companies that utilize it, and especially for the companies that provide the underlying technology.

However, the outperformance of the market-weight index over the equal-weight index serves as a reminder of the market's concentration. While the headline numbers are strong, the gains are not being shared equally across all 500 companies in the index. This suggests that a company's ability to leverage new technologies like AI is becoming a key differentiator for success in today's economy.