The U.S. dollar climbed to its highest level in three months this week, driven by a combination of a more assertive Federal Reserve and a weakening Japanese yen. The surge reflects shifting expectations among global investors regarding central bank policies in the world's major economies.

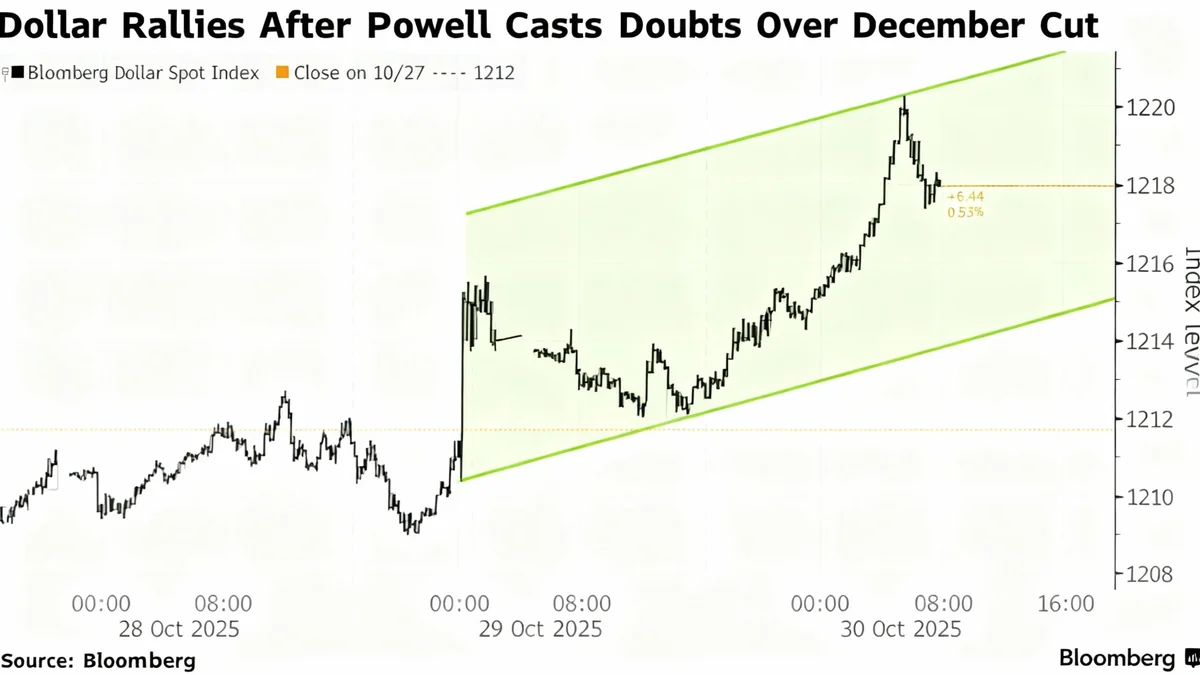

The Bloomberg Dollar Spot Index, a key measure of the dollar's strength against a basket of other major currencies, increased by as much as 0.6% to reach a peak not seen since early August. The move positions the dollar for its second consecutive month of gains, signaling a significant shift in market sentiment.

Key Takeaways

- The U.S. dollar reached its highest value in three months, with the Bloomberg Dollar Spot Index rising up to 0.6%.

- The Federal Reserve signaled a pullback from further interest rate cuts this year, adopting a more "hawkish" stance.

- The Bank of Japan held its benchmark rate, dampening expectations for rate hikes and causing the yen to fall to an eight-month low.

- Increased economic uncertainty in the U.S. has also contributed to the dollar's strength as investors seek stability.

Federal Reserve Signals a Pause on Rate Cuts

A primary driver behind the dollar's recent strength was the latest announcement from the U.S. Federal Reserve. While the central bank proceeded with an expected quarter-point rate cut on Wednesday, Chairman Jerome Powell's subsequent comments caught the market's attention.

Powell cautioned that another rate cut in December is not a certainty, effectively curtailing market expectations for continued monetary easing this year. This more cautious, or "hawkish," tone suggests the Fed may be finished with its cycle of rate reductions for now.

"It’s a follow on from a hawkish Fed," said Aroop Chatterjee, a strategist at Wells Fargo, explaining the dollar's upward momentum.

This policy pivot makes holding U.S. dollars more attractive to investors, as higher potential interest rates generally lead to higher returns on dollar-denominated assets.

Navigating Economic Uncertainty

Compounding the situation is a lack of official economic data from the U.S. government due to a recent shutdown. This information void has made it difficult for analysts and the Fed to get a clear picture of the economy's health, creating a climate of uncertainty that often benefits the dollar as a perceived safe-haven currency.

Bank of Japan's Policy Divergence Weakens Yen

Adding fuel to the dollar's rally was a contrasting move from the Bank of Japan (BOJ). On Thursday, the BOJ left its own benchmark interest rate unchanged and offered few signals that a rate hike was imminent. This decision immediately pushed the yen down to its weakest level against the dollar since February.

The Japanese currency fell to 154.14 per dollar in New York trading. The policy divergence—with the U.S. central bank holding firm while Japan's remains accommodative—has made the dollar significantly more appealing than the yen.

According to Nathan Thooft, a senior portfolio manager at Manulife Investment Management, this may be part of a deliberate strategy.

"The recent tone from the new Japanese administration has been pro-growth," Thooft noted. "And to accomplish that policy, they are willing to accept a weaker yen. In fact, they would prefer it."

A weaker yen can make Japanese exports cheaper and more competitive on the global market, potentially stimulating economic growth.

Global Currency Impact

The dollar's strength was not limited to the yen. The euro also fell 0.2% against the dollar. In fact, every currency in the Group of 10 (G10), which includes the world's most traded currencies, traded lower against the greenback following the central bank announcements.

Broader Market Sentiment and Investor Positioning

The dollar's rise reflects a broader trend in global financial markets. This week saw significant central bank activity, with the European Central Bank also choosing to leave its interest rates unchanged for the third consecutive meeting, citing steady economic growth and contained inflation.

The collective actions of these central banks have solidified the dollar's position as a preferred asset. This sentiment is also visible in the options market, where the cost to hedge against a further rise in the U.S. dollar is near its highest point since April.

This indicates that professional traders are increasingly positioning themselves for sustained dollar strength over the next year. As long as uncertainty persists and the Federal Reserve maintains its steady policy stance, the dollar is likely to remain a dominant force in foreign exchange markets.