Bitcoin Price Enters Key Decision Zone Near $90,000

Bitcoin is trading in a tight consolidation range between $85,400 and $93,000, with analysts watching for a major breakout that could target $100,000 or a breakdown toward $72,000.

39 articles tagged

Bitcoin is trading in a tight consolidation range between $85,400 and $93,000, with analysts watching for a major breakout that could target $100,000 or a breakdown toward $72,000.

The EUR/USD currency pair is facing downward pressure for the second consecutive day, testing the 1.1600 level as the US Dollar strengthens.

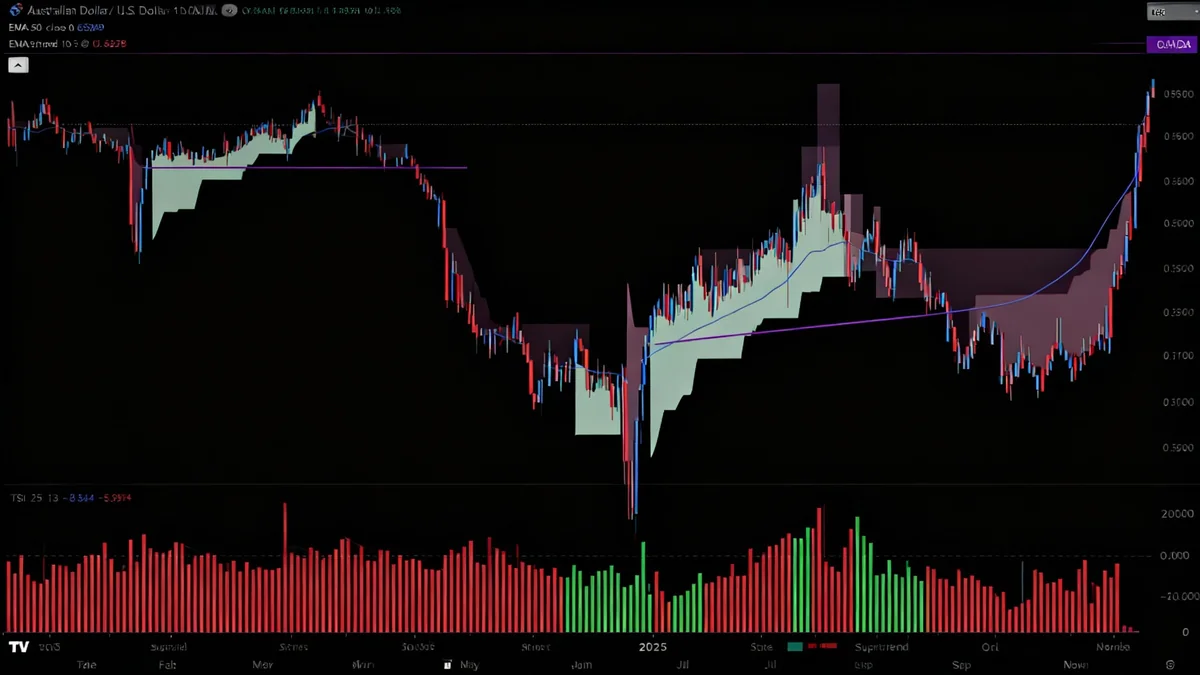

The Australian dollar is holding at a critical 0.6500 support level as traders await key jobs data and signals from the U.S. Federal Reserve.

USD/JPY rebounded above 153.00, erasing Thursday's losses as US Dollar demand strengthened with stable Treasury yields. Technicals suggest bullish continuation.

The EUR/USD currency pair is under significant pressure, approaching the critical 1.1400 support level as markets weigh central bank policies and await key US data.

Market analysis suggests gold is in a final corrective dip, with a target price of $3,782–$3,797, before a potential medium-term rally begins.

The Euro has fallen below the critical 1.1600 support level against the US Dollar, signaling a bearish turn as the pair trades below key moving averages.

Ethereum is trading near $3,866, consolidating within a critical symmetrical triangle pattern that suggests a major price move is imminent.

Chainlink (LINK) is caught in a tight trading range, holding firm above the critical $16 support but struggling to overcome resistance at $20.

The European Central Bank is expected to hold interest rates at 2%, but strong economic data could lead to a hawkish surprise, impacting the Euro.

Gold futures are testing a critical support zone near $3,950 after a 10% drop, with traders watching for a potential technical rebound based on a specific price pattern.

Silver (XAG/USD) is clinging to $47.50 support amid a strengthening dollar and weak industrial demand. Technicals show a downtrend, with key EMAs acting as resistance. A confirmed bounce and break abo