Advanced Micro Devices (AMD) has significantly raised its forecast for the artificial intelligence data center market, now projecting it will reach $1 trillion by the end of the decade. This new estimate, double its previous projection, was unveiled during the company's first Analyst Day in three years, signaling a major push against current market leader Nvidia.

The announcement, coupled with a series of high-profile partnerships, sent AMD's stock soaring by 9% as investor confidence in its AI strategy strengthened. The company outlined ambitious long-term financial goals, including an earnings per share (EPS) target exceeding $20, which is well above prior Wall Street expectations.

Key Takeaways

- AMD has doubled its estimated data center Total Addressable Market (TAM) to $1 trillion by 2030, driven by AI demand.

- The company announced major partnerships with OpenAI, Oracle, and Meta, strengthening its position as a viable Nvidia alternative.

- Following its Analyst Day, AMD's stock price jumped 9%, reflecting renewed investor optimism.

- Top analysts see significant long-term potential, with some price targets suggesting nearly 30% upside from current levels.

A New Vision for the AI Data Center

During its recent Analyst Day, AMD executives laid out a strategic roadmap that places the company at the center of the rapidly expanding AI ecosystem. The cornerstone of this strategy is the revised projection for the data center silicon market, which the company now believes will reach an astounding $1 trillion within the next six years. This is a dramatic increase from its previous estimate of $500 billion.

This aggressive forecast is built on surging demand for both AI training and inference workloads. The company is positioning its portfolio of server CPUs and increasingly competitive AI GPUs to capture a significant share of this growth. To support this vision, AMD presented a robust long-term financial outlook that includes notable margin improvements and an EPS forecast that surpasses current analyst consensus.

Financial Outlook at a Glance

- Projected Data Center TAM: $1 trillion by 2030

- Long-Term EPS Target: Above $20 per share

- Post-Event Stock Surge: +9%

Major Partnerships Signal Growing Trust

AMD's ambitious projections are backed by a growing list of marquee customers committing to its technology. These partnerships demonstrate that major industry players are actively seeking alternatives to Nvidia's dominant, and often supply-constrained, hardware.

Several key collaborations were highlighted, indicating significant momentum for AMD's AI accelerators:

- OpenAI: A deal for 6 gigawatts of capacity.

- Oracle: An agreement for 50,000 MI450 GPUs.

- Meta: The social media giant co-defined AMD's Helios platform.

- U.S. Government: Two new supercomputers for the Department of Energy will be powered by AMD silicon.

The company also mentioned several Sovereign AI projects and deep engagements with leading hyperscalers, many of whom are planning major deployments of AMD hardware beginning in the second half of next year. This expanding customer base is a critical component of AMD's strategy to erode Nvidia's market share.

The Nvidia Alternative Customers Demand

The demand for a strong competitor to Nvidia has never been higher. Many large-scale AI developers and cloud providers are looking to diversify their supply chains and avoid reliance on a single vendor's closed and proprietary architecture. Nvidia has also struggled to fully meet the explosive market demand, creating an opening for rivals.

According to Cody Acree, a top-ranked analyst at Benchmark, this dynamic is a key driver of AMD's recent success. He believes customers are "aggressively demanding" larger volumes of high-performance computing resources and are eager for a viable alternative supplier.

"While we don’t expect Nvidia to make the same technological competitive mistakes as Intel, we believe the customers of the AI industry are even more eager for a viable supply alternative compared to where the compute industry was just a few years ago," Acree stated.

He drew a parallel between AMD's current challenge to Nvidia and its past, successful competition against Intel in the CPU market. In that instance, AMD methodically gained market share through years of consistent innovation and an ambitious product roadmap. Acree suggests a similar pattern may be emerging in the AI accelerator space.

The Competitive Landscape

For years, Nvidia has held a near-monopoly on the high-end GPUs used for training large AI models. Its CUDA software platform created a powerful ecosystem that was difficult for competitors to penetrate. However, the sheer scale of AI investment has created an urgent need for more hardware than one company can supply, giving AMD a crucial opportunity to establish itself as the primary alternative.

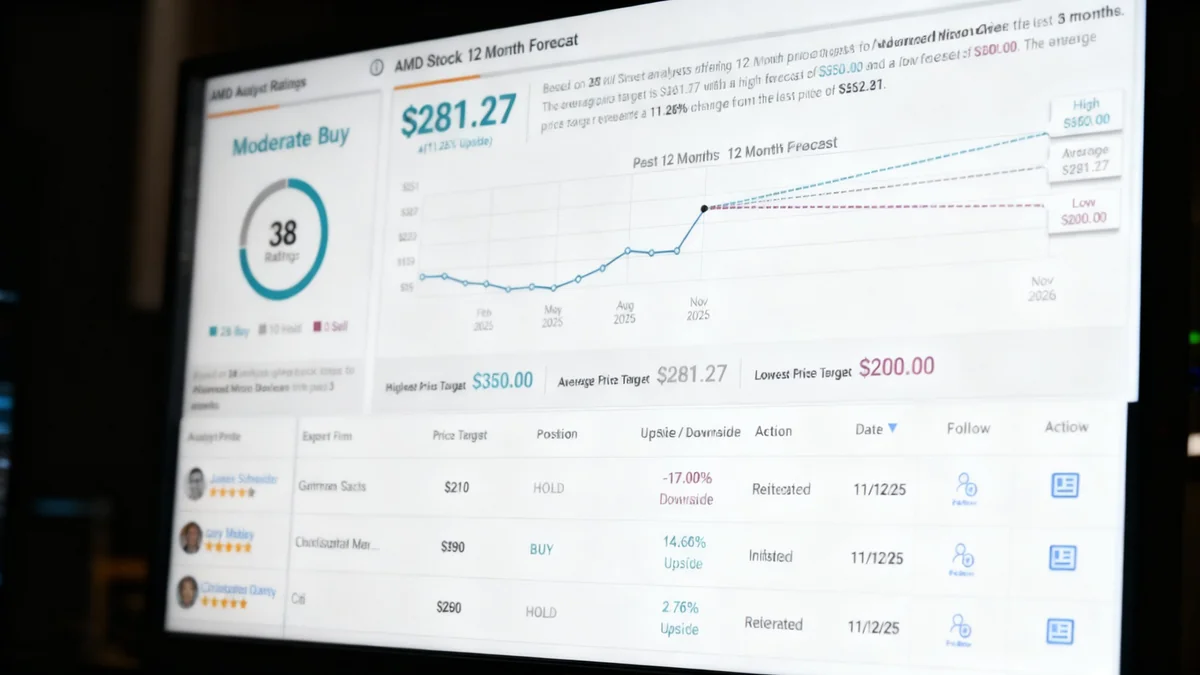

Wall Street's Take: A Buy Rating with High Hopes

Analysts are taking note of AMD's strengthening position. Acree maintained his Buy rating on AMD shares and set a price target of $325, which suggests a potential upside of 28.5% in the coming months. He argued that the stock does not yet fully reflect the company's long-term potential as a credible AI competitor.

He believes AMD is in the "very early stages" of benefiting from years of investment and development, especially as AI inference workloads become more widespread. The recent surge in stock price, in his view, is a logical reaction to the company's growing leverage in the AI data center market.

The broader Wall Street consensus is also positive, though more moderate. The stock holds a Moderate Buy consensus rating, based on 28 Buy ratings and 10 Hold ratings. The average price target stands at $281.27, implying an 11% return over the next 12 months. This indicates that while many analysts are bullish, some are waiting for further proof of execution before fully embracing the high-growth narrative.