Vanguard Executive Calls Bitcoin a 'Digital Toy'

A senior Vanguard executive has publicly described Bitcoin as a speculative asset, comparing it to a collectible toy, despite the firm allowing client access to crypto ETFs.

Marcus Reid is a financial analyst specializing in digital assets and market structure. He covers the intersection of traditional finance and cryptocurrency, focusing on ETFs, derivatives, and regulatory developments.

Portfolio

A senior Vanguard executive has publicly described Bitcoin as a speculative asset, comparing it to a collectible toy, despite the firm allowing client access to crypto ETFs.

Binance has approved BlackRock's $2.5 billion tokenized fund, BUIDL, as collateral, marking a major step in integrating traditional finance with the crypto market.

Spot Bitcoin ETFs saw over $1.2 billion in outflows last week, the third-largest on record, yet prices rebounded, suggesting profit-taking over panic.

Institutional investors are expanding their focus beyond Bitcoin, with a potential Dogecoin ETF, major investments in Ethereum treasuries, and growing interest in privacy coins like Zcash.

The SPDR S&P 500 ETF (SPY) closed slightly higher in a volatile session, buoyed by $9 billion in recent investor inflows despite weakness in the technology sector.

Strategy CEO Michael Saylor has projected a Bitcoin price of $150,000 by year-end, citing forthcoming institutional adoption as a key driver for growth.

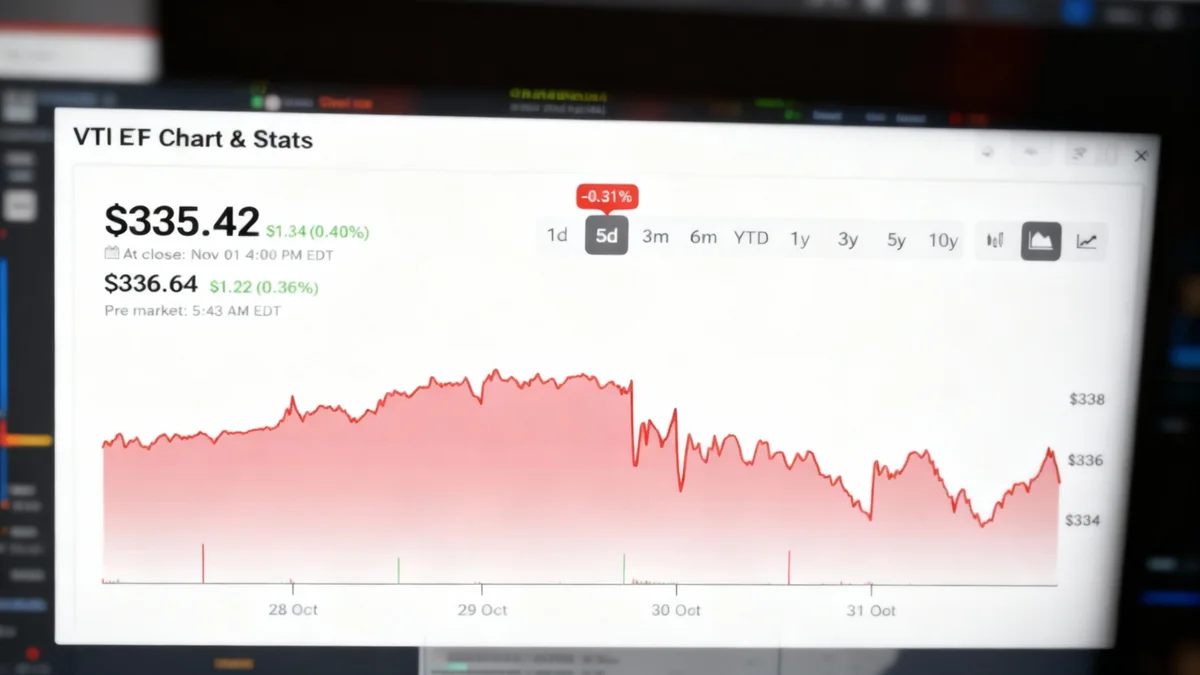

The Vanguard Total Stock Market ETF (VTI) has attracted $1 billion in net inflows over the past five days, signaling strong investor confidence.

While a quantum computer capable of breaking Bitcoin's security is likely a decade away, experts warn the real threat is market panic fueled by misinformation.

Bitcoin's price hit a new November high of $111,129 over the weekend, but the rally faces skepticism due to ongoing whale selling and the unreliable nature of 'Sunday pumps'.

A prominent crypto analyst explains why XRP has shown remarkable stability, attributing its strength to a base of older, long-term investors rather than market hype.

Discover three distinct index ETFs that can form the foundation of a long-term investment portfolio, catering to goals from broad market tracking to growth and dividend income.

Standard Chartered Bank projects the market for tokenized real-world assets could surge to nearly $2 trillion by 2028, with Ethereum expected to lead.

Seventeen years after its creation, Bitcoin has transformed from a niche cypherpunk project into a major financial asset embraced by Wall Street and governments.

Bitcoin's seven-year October winning streak has ended, with the cryptocurrency recording a nearly 5% loss for the month, its first since 2018.

Florida residents have lost over $1.1 million to a cryptocurrency investment scam. Fraudsters use social media to lure victims, promising high returns on fake platforms and demanding more money for wi

Canary Funds has advanced its XRP ETF filing, setting a potential launch date for November. The move comes as institutional interest rises, but on-chain data shows a conflicting drop in payment volume

Bitwise CIO Matt Hougan presents a compelling investment case for Solana, arguing it offers a dual opportunity for growth similar to Bitcoin's early potential.

Asset manager 21Shares has filed an application with the SEC for a new ETF that would track the Hyperliquid (HYPE) token, marking the second such proposal.

Investment funds tracking XRP have surpassed $1 billion in assets, as the market anticipates a crucial SEC decision on spot ETFs expected between October and November.

Investors seeking consistent passive income can explore several high-yield dividend ETFs, each with a unique strategy for generating returns.