Microsoft Corporation (MSFT) announced robust financial results for the first quarter of fiscal year 2026, surpassing analyst expectations for both earnings and revenue. The technology giant reported non-GAAP earnings per share (EPS) of $4.13, significantly beating estimates by $0.47. Quarterly revenue reached $77.67 billion, exceeding projections by $2.28 billion.

Key Takeaways

- Microsoft reported Q1 2026 non-GAAP EPS of $4.13, beating estimates by $0.47.

- Revenue for the quarter hit $77.67 billion, surpassing expectations by $2.28 billion.

- Intelligent Cloud segment revenue increased by 28%.

- The company generated $25 billion in free cash flow during the quarter.

- Despite strong results, the stock saw a slight dip in after-hours trading.

Strong Performance Across Key Segments

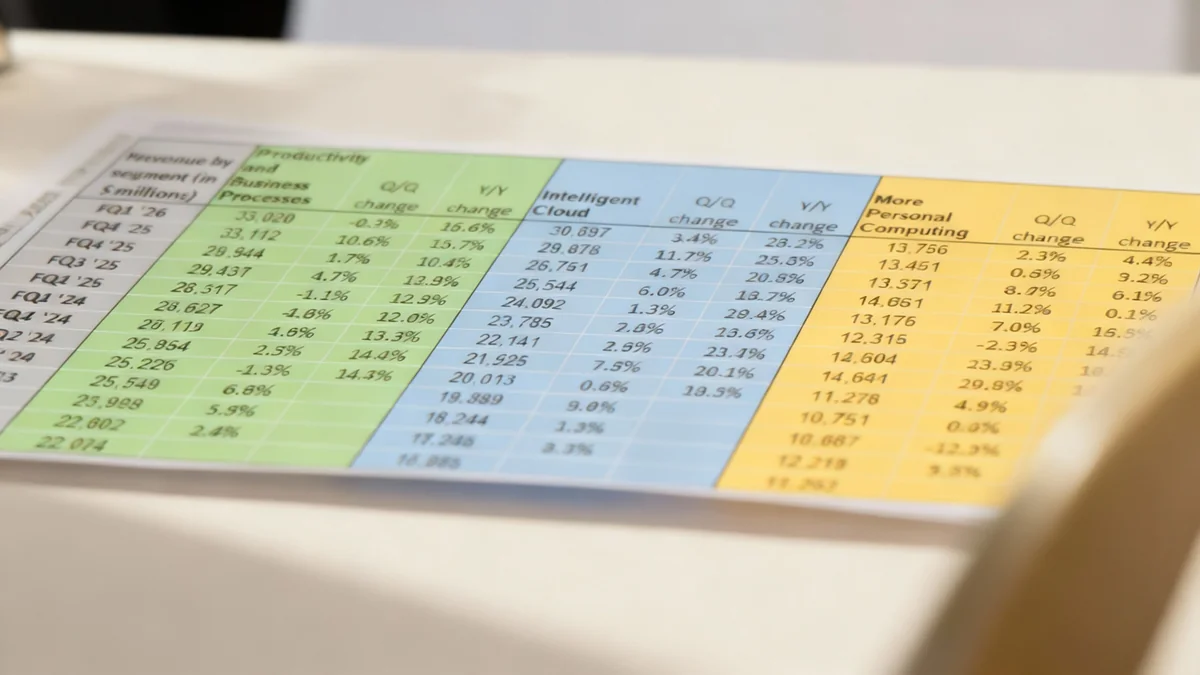

Microsoft's impressive first-quarter performance was driven by strong growth in its Intelligent Cloud division. This segment, which includes Azure cloud services, server products, and enterprise services, saw a significant 28% increase in revenue. This growth highlights the company's continued dominance in the cloud computing market, a critical area for enterprise digital transformation.

The company's diverse portfolio, spanning cloud services, productivity software, and gaming, contributed to its overall financial health. Analysts had closely watched these results, particularly given recent market volatility.

Quarterly Highlights

- Non-GAAP EPS: $4.13

- Total Revenue: $77.67 billion

- Intelligent Cloud Revenue Growth: 28%

- Free Cash Flow: $25 billion

Intelligent Cloud Fuels Growth

The Intelligent Cloud segment remains a primary growth engine for Microsoft. The 28% revenue climb underscores the increasing demand for cloud infrastructure and services from businesses globally. Azure, Microsoft's public cloud platform, continues to compete effectively in a highly competitive market, securing major contracts and expanding its service offerings.

This sustained growth in cloud services is vital for Microsoft's long-term strategy. It allows the company to capitalize on the ongoing shift towards cloud-based solutions across various industries. The investments in data centers and AI capabilities within this segment are clearly paying off.

"This company is a wealth generator," one investor commented, reflecting the positive sentiment around Microsoft's consistent performance.

Financial Stability and Free Cash Flow

Despite concerns regarding capital expenditures, Microsoft demonstrated substantial financial stability. The company reported a robust $25 billion in free cash flow for the quarter. This significant cash generation capacity provides Microsoft with ample resources for strategic investments, share buybacks, and potential acquisitions.

High free cash flow indicates a company's ability to generate cash after accounting for operating expenses and capital expenditures. For investors, it signals financial health and flexibility. This metric is particularly important in a dynamic economic environment, allowing Microsoft to pursue innovation and expand its market reach.

Market Context

Microsoft is one of the "Magnificent Seven" technology giants, closely watched by investors. Its performance often serves as an indicator for the broader technology sector. The company's diverse revenue streams, from enterprise software to gaming with Xbox, provide resilience against market fluctuations.

Market Reaction and Outlook

Despite the strong earnings report, Microsoft's stock saw a slight dip in after-hours trading. This reaction, though initially puzzling to some, is not uncommon following major earnings announcements. Investors often take profits or adjust positions even after positive news. However, many analysts and investors maintain an optimistic outlook.

One investor noted, "not the sexiest of the big 7, but they are a monumental rock solid revenue company." This sentiment highlights Microsoft's consistent ability to generate substantial revenue and profit, making it a cornerstone of many investment portfolios.

The long-term prospects for Microsoft appear strong, driven by continued innovation in cloud computing, artificial intelligence, and enterprise solutions. The company's ability to consistently exceed expectations underscores its strong market position and operational efficiency.

Future Growth Drivers

- Continued expansion of Azure cloud services.

- Integration of AI across its product ecosystem.

- Growth in productivity and business process software.

- Strategic investments in emerging technologies.

Microsoft's performance reinforces its position as a leading technology firm, capable of delivering substantial returns even amidst broader economic uncertainties. The company's focus on high-growth areas like cloud and AI is expected to sustain its momentum in the coming quarters.