Australian Dollar Hits Two-Month High on RBA and China News

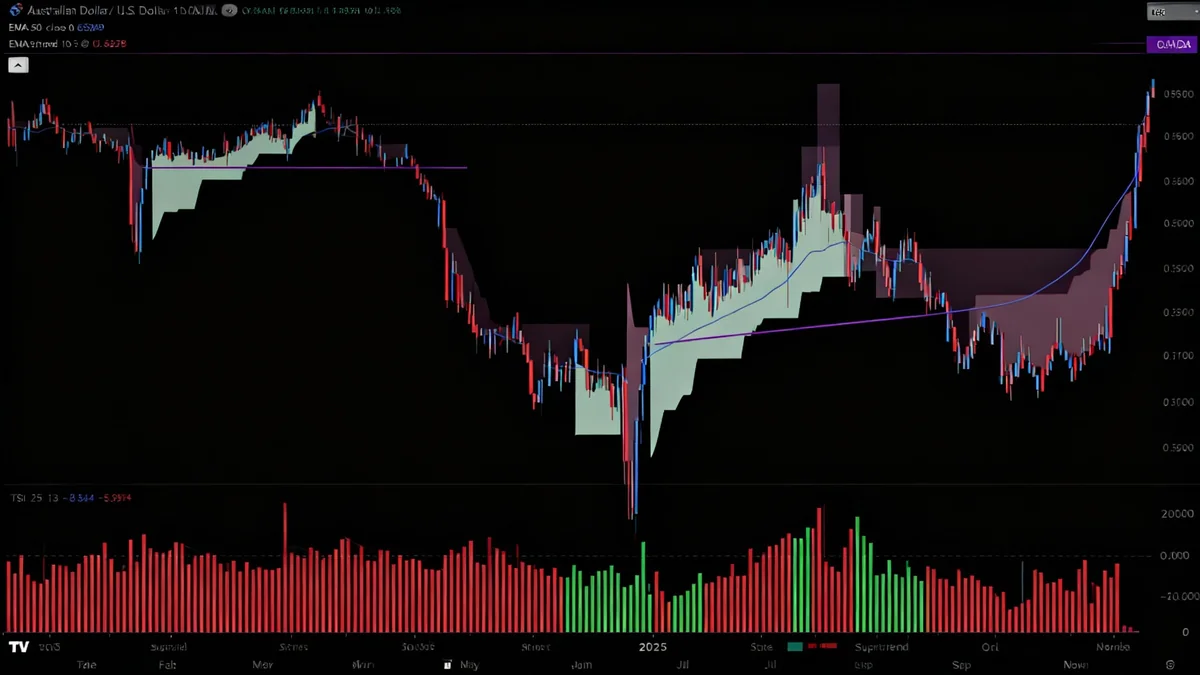

The Australian dollar has extended its winning streak to 12 days, reaching a two-month high near 0.6650 against the U.S. dollar amid key economic signals.

11 articles tagged

The Australian dollar has extended its winning streak to 12 days, reaching a two-month high near 0.6650 against the U.S. dollar amid key economic signals.

The Australian dollar is holding at a critical 0.6500 support level as traders await key jobs data and signals from the U.S. Federal Reserve.

The Australian dollar weakened against the U.S. dollar as traders anticipate the RBA's policy decision and reassess bets on a Federal Reserve rate cut.

The Australian dollar surged to its highest point since early October after strong inflation data reduced the likelihood of an RBA interest rate cut.

The Australian dollar faces a volatile week as traders await Australia's crucial inflation data, a U.S. Federal Reserve decision, and news from U.S.-China trade talks.

The Australian dollar is trading in a tight range near 0.6491, weighed down by a strong U.S. dollar and a bearish technical outlook below key moving averages.

The AUD/USD currency pair held steady near the 0.6500 level following comments from U.S. President Trump suggesting a softer trade stance on China.

The Australian dollar is under pressure from renewed U.S.-China trade tensions and weakening domestic data, with markets eyeing RBA minutes and jobs figures.

The Australian dollar is gaining as the U.S. dollar weakens on concerns of a potential government shutdown and growing expectations of a Federal Reserve rate cut.

The Australian Dollar advanced after new data showed inflation rising to 3.0% in August, complicating the Reserve Bank of Australia's plans for future rate cuts.

The U.S. dollar strengthened after the Federal Reserve's 25bp rate cut was less aggressive than expected, putting AUD/USD and GBP/AUD in focus.