Alibaba Group Holding Ltd. announced a significant increase to its artificial intelligence budget, expanding on its previous $53 billion plan. The news, revealed at the Apsara Conference, was accompanied by the launch of a new large language model and a strategic partnership with Nvidia, causing the company's shares (BABA) to climb 8.19%.

Key Takeaways

- Alibaba will increase its AI spending beyond its initial $53 billion commitment to compete in the expanding global market.

- The company launched Qwen3-Max, a new large language model with over one trillion parameters, designed for advanced coding and autonomous tasks.

- A new partnership with Nvidia will integrate Nvidia's Physical AI software into Alibaba's cloud platform, focusing on robotics and autonomous systems.

- Alibaba Cloud is expanding its global footprint with new data centers in Brazil, France, and the Netherlands.

- Investor confidence grew as Cathie Wood’s Ark Investment Management bought Alibaba shares for the first time since 2021.

Alibaba Deepens Commitment to Artificial Intelligence

Alibaba Group has signaled a major escalation in its artificial intelligence strategy, confirming it will boost its investment beyond an earlier $53 billion plan. The announcement was a central theme at the company's Apsara Conference, a key event for its technology division.

Chief Executive Officer Eddie Wu provided context for the decision, highlighting the rapid growth of the AI sector. He noted that global investment in AI could reach an estimated $4 trillion over the next five years. Wu emphasized that it is critical for Alibaba to maintain a competitive position as the demand for sophisticated AI infrastructure accelerates worldwide.

This strategic pivot is designed to ensure Alibaba remains a key player in a market dominated by intense competition from both international and domestic rivals. The increased capital allocation will target core infrastructure, research, and development to support the next generation of AI applications.

The Global AI Arms Race

Companies across the globe are pouring unprecedented sums into AI development. The race to build more powerful large language models and the infrastructure to support them has become a defining feature of the modern technology landscape. Alibaba's move reflects a broader industry trend where significant, sustained investment is seen as essential for survival and growth.

New Technology and Global Infrastructure Expansion

Alongside its financial commitments, Alibaba unveiled its latest large language model, Qwen3-Max. This new model is built with over one trillion parameters, a key metric indicating its potential complexity and capability. According to the company, Qwen3-Max demonstrates superior performance in specialized areas like coding and autonomous agent tasks when compared to competing models.

The development of proprietary models like Qwen3-Max is crucial for technology giants looking to offer unique AI services and reduce reliance on third-party technology. It allows Alibaba to tailor solutions for its vast e-commerce, finance, and logistics ecosystem.

To support its growing AI ambitions, Alibaba Cloud also announced a significant international expansion. The company is launching its first data centers in three new markets:

- Brazil

- France

- The Netherlands

This expansion is a clear effort to extend its cloud computing services beyond its home market in China. By establishing a physical presence in these regions, Alibaba Cloud can offer lower latency and cater more effectively to the data sovereignty requirements of international clients.

Strategic Partnership with Nvidia Amid Trade Tensions

Perhaps one of the most significant developments was the announcement of a partnership between Alibaba Cloud and U.S. chipmaker Nvidia. The collaboration will bring Nvidia’s Physical AI software stack to Alibaba’s cloud platform. This technology is designed to help developers build and deploy AI models for robotics, autonomous vehicles, and other smart environments.

According to Bloomberg, the deal focuses on enabling the development of AI for physical applications, a rapidly growing segment of the industry that includes factory automation and self-driving cars.

This alliance is particularly noteworthy given the ongoing trade restrictions between the United States and China, which have impacted the flow of advanced semiconductor technology. The partnership demonstrates that despite geopolitical tensions, the demand for cutting-edge AI tools is driving new forms of collaboration between industry leaders.

The collaboration highlights the indispensable role of Nvidia's technology in the global AI ecosystem and Alibaba's determination to provide its customers with access to leading tools, navigating a complex regulatory environment to do so.

Market Reacts Positively to Alibaba's Strategy

The series of announcements provided a substantial boost to investor sentiment, with Alibaba's stock (BABA) closing up 8.19% on Wednesday. The market's positive reaction reflects confidence in the company's renewed focus and aggressive strategy to capture a larger share of the global AI market.

Further bolstering this confidence was news that Cathie Wood’s Ark Investment Management has reopened a position in Alibaba. This marks the first time the influential investment firm has held the stock since 2021, a move widely interpreted as a signal of renewed institutional interest in the Chinese tech giant after a period of regulatory uncertainty.

The positive momentum was not limited to Alibaba. Marvell Technology (MRVL), another key player in the data center and AI infrastructure space, also saw its stock rise after announcing a $5 billion stock buyback program. This included a $1 billion accelerated purchase, signaling its own confidence in future growth driven by the data center sector.

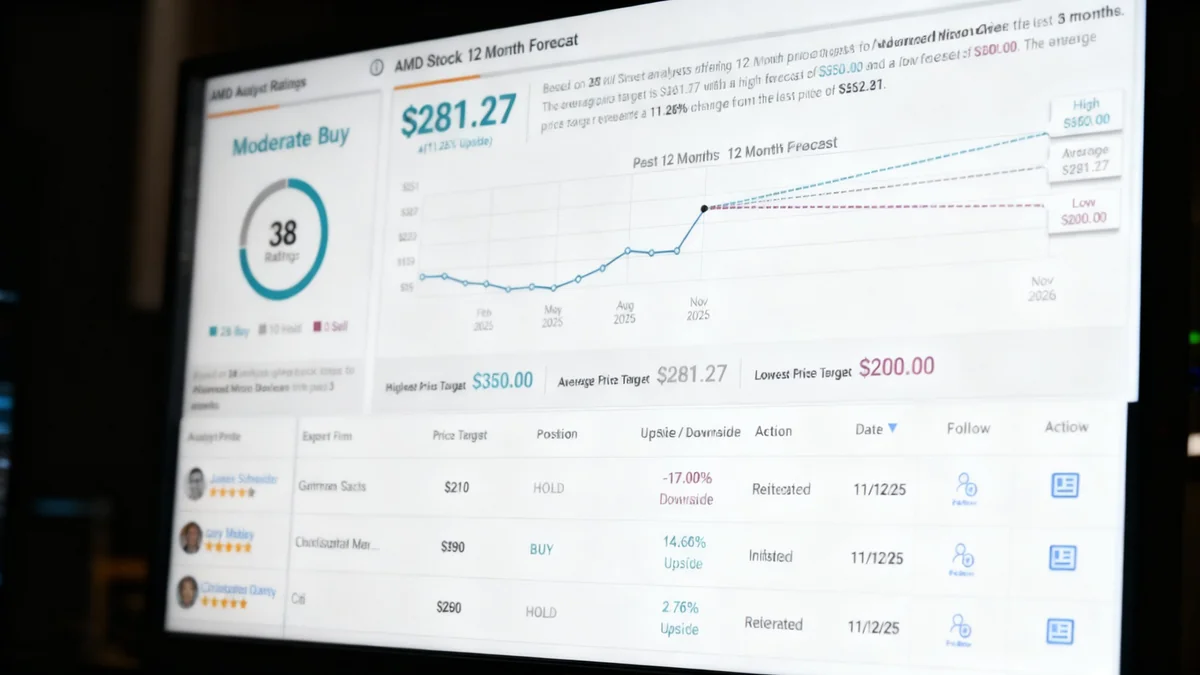

Analyst Outlook on BABA

Wall Street analysts maintain a positive outlook on Alibaba. Based on the ratings of 18 analysts, the stock holds a "Strong Buy" consensus. However, the average price target of $172.40 suggests that analysts may see the stock as approaching its fair value in the near term, implying a slight downside from its recent peak.

In summary, Alibaba's multi-faceted strategy—combining increased investment, new technology, global expansion, and key partnerships—has successfully reignited market interest. The moves position the company to better compete in the next phase of AI development, with investors closely watching to see if this momentum can be sustained.