The technology sector is undergoing a significant transformation as central banks worldwide continue to raise interest rates to combat persistent inflation. This shift marks the end of a long period of easily accessible, low-cost capital, forcing a major re-evaluation of company valuations, investment strategies, and operational priorities for firms ranging from startups to established tech giants.

For over a decade, the tech industry thrived on a foundation of near-zero interest rates, which fueled rapid growth, aggressive hiring, and high-risk investments. Now, with the cost of borrowing on the rise, investors are becoming more selective, demanding clearer paths to profitability and sustainable business models over growth at any cost.

Key Takeaways

- Rising interest rates have increased the cost of capital, making it more expensive for technology companies to borrow and fund operations.

- Investor focus has shifted from rapid growth to profitability, leading to lower valuations for many tech firms, especially those not yet profitable.

- Venture capital funding has slowed significantly, with investors conducting more rigorous due diligence before committing capital.

- Tech companies are responding by implementing cost-cutting measures, including layoffs, reduced spending, and a focus on core business functions.

The End of an Era for Cheap Money

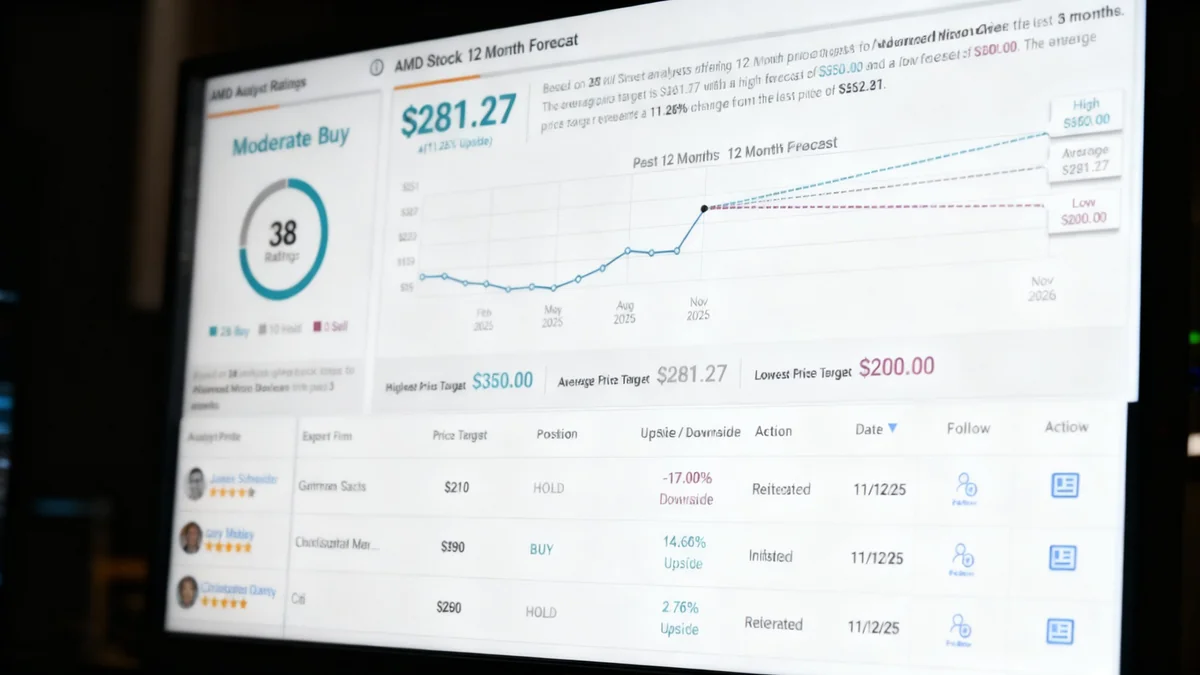

The primary mechanism through which interest rates affect tech valuations is the discounted cash flow (DCF) model. This method calculates a company's present value based on its projected future cash flows. When interest rates rise, the discount rate used in these calculations also increases.

A higher discount rate means that future earnings are worth less in today's dollars. This has a disproportionate impact on growth-oriented tech companies, whose valuations are often heavily weighted toward profits expected far into the future. As a result, many have seen their market capitalizations decline substantially from the peaks seen in recent years.

Understanding Discount Rates

The discount rate represents the return an investor could expect from an alternative investment with similar risk. When government bond yields (a proxy for the risk-free rate) go up, the discount rate used for riskier assets like tech stocks must also increase to compensate for the additional risk, thus lowering their present value.

This financial pressure is not limited to publicly traded companies. Private startups are also feeling the impact as venture capital firms become more cautious. The era of securing massive funding rounds with little more than a promising idea and a large total addressable market is fading.

Venture Capital Pullback and Startup Challenges

Venture capital (VC) funding is the lifeblood of the startup ecosystem. However, recent data shows a marked slowdown in investment activity. According to industry reports, global venture funding in the first half of this year was down approximately 45% compared to the same period last year.

Investors are now applying greater scrutiny to a startup's fundamentals. Key metrics under the microscope include:

- Path to Profitability: A clear and realistic timeline for achieving positive cash flow.

- Customer Acquisition Cost (CAC): The cost of acquiring new customers must be sustainable.

- Burn Rate: The rate at which a company is spending its capital reserves.

- Unit Economics: The profitability of each individual sale or customer.

By the Numbers: VC Funding Slowdown

Reports indicate that the number of "mega-rounds" (funding rounds of $100 million or more) has decreased by over 60% year-over-year. This highlights a significant shift away from late-stage, high-valuation deals toward more conservative, early-stage investments.

This new environment forces startups to adapt quickly. Many are extending their financial runways by cutting costs, pausing non-essential projects, and focusing on retaining existing customers rather than pursuing aggressive expansion. For some, this means accepting lower valuations in subsequent funding rounds, a phenomenon known as a "down round."

Corporate Response: A Shift to Efficiency

In response to the changing economic landscape, established technology companies have also pivoted their strategies. The focus has moved decisively from a "growth-at-all-costs" mindset to an emphasis on operational efficiency and profitability.

This strategic shift is most visible in the widespread layoffs that have affected the sector. Companies that hired aggressively during the pandemic-fueled tech boom are now reducing their workforce to align with more conservative growth projections. Tens of thousands of jobs have been cut across the industry as firms seek to streamline operations and reduce overhead.

"We are operating in a new reality of higher interest rates and greater economic uncertainty. Our focus must be on building a durable, profitable business that can thrive in any environment, not just one with zero-cost capital."

Beyond layoffs, companies are also re-evaluating their spending on marketing, research and development, and employee perks. Lavish office spaces and extensive benefits, once hallmarks of the tech industry, are being scaled back in favor of more disciplined financial management. The goal is to preserve cash and strengthen balance sheets to weather potential economic downturns.

Long-Term Outlook for the Tech Industry

While the current environment presents significant challenges, many analysts believe it will lead to a healthier and more sustainable technology sector in the long run. The increased focus on financial discipline is expected to foster more resilient business models and discourage the kind of speculative excess seen in previous years.

Companies that can demonstrate strong product-market fit, efficient operations, and a clear path to profitability are likely to attract investment and succeed. The era of easy money may be over, but innovation will continue. The key difference is that this innovation will be built on a more solid financial foundation.

The current cycle is a reminder that the technology industry is not immune to broader macroeconomic forces. The ability to adapt to changing capital market conditions is now as critical as technological innovation itself. As the sector adjusts, the companies that emerge strongest will be those that successfully balance growth ambitions with prudent financial management.