Major technology companies are significantly increasing their investments in artificial intelligence (AI) infrastructure, signaling a multi-year growth cycle for semiconductor firms. This surge in capital expenditure by industry giants like Alphabet, Meta Platforms, and Microsoft is driving investor attention towards chipmakers and networking companies.

Key Takeaways

- Big Tech is increasing AI infrastructure spending through 2026 and beyond.

- Semiconductor companies like Nvidia and Broadcom are key beneficiaries.

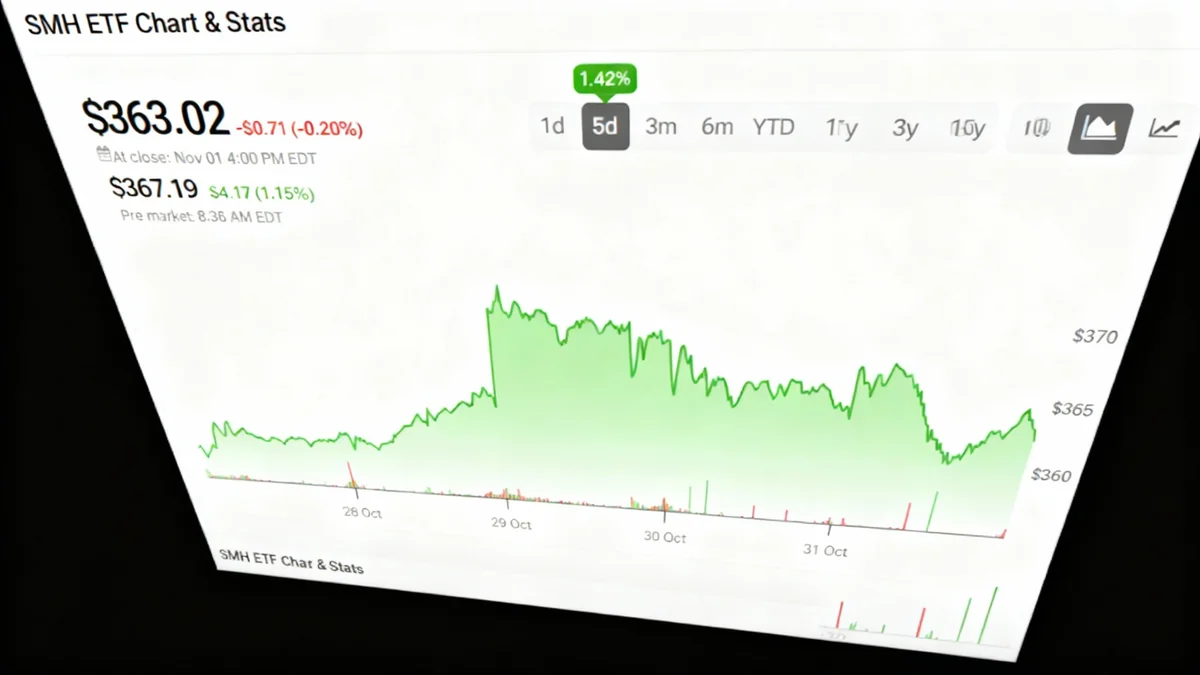

- The VanEck Semiconductor ETF (SMH) has gained nearly 50% year-to-date.

- Analysts maintain a 'Moderate Buy' rating on SMH, with a 7% implied upside.

- Memory makers and networking firms are also expected to see significant gains.

Big Tech Fuels AI Investment Cycle

The earnings reports from large technology companies have put a spotlight on the massive spending directed towards artificial intelligence. Analysts predict that this elevated spending by major U.S. cloud providers and other tech firms will continue well into 2026. This extends a multi-year investment cycle that directly benefits chip manufacturers and networking companies involved in AI data centers.

Alphabet, for example, has raised its capital spending plans for 2025 to a range of $91 billion to $93 billion. This is a notable increase from its previous budget of $85 billion. Similarly, Meta Platforms now expects its 2025 capital expenditure to fall between $70 billion and $72 billion, up from prior estimates.

Did You Know?

Microsoft's capital expenditure for Q1 FY26 was higher than anticipated at $34.9 billion, and the company expects its fiscal 2026 capital expenditure growth rate to surpass that of fiscal 2025.

JPMorgan's Optimistic Outlook for Chip Stocks

JPMorgan analysts have observed that Microsoft, Alphabet, and Meta Platforms have each increased their capital expenditure budgets for 2025 and indicated further rises for 2026. These tech giants are reinforcing expectations for sustained growth in AI-related investments across computing, networking, and storage.

JPMorgan stated that the spending updates by tech giants "corroborate" its view that cloud and hyperscale data center spending will remain "structurally elevated" over the longer term as demand for AI computing continues to rise.

The investment bank specifically identifies several key beneficiaries from the surging demand for AI servers and chips. These include Nvidia, Broadcom, Marvell Technology, and Advanced Micro Devices (AMD). Memory manufacturers like Micron and Western Digital are also expected to gain, alongside networking firms such as Allegro MicroSystems and MACOM Technology.

Semiconductor ETF Performance and Analyst Views

The VanEck Semiconductor ETF (SMH) has seen strong performance recently. It gained 1.4% over the past five days and remains up nearly 50% year-to-date. This ETF tracks the performance of the MVIS US Listed Semiconductor 25 index, and its recent movements are largely due to high-profile deals within the AI sector.

Shares of its top 10 holdings, including Nvidia, Taiwan Semiconductor, and Micron, have been trending higher. This upward momentum reflects the broader market's confidence in the semiconductor industry's role in the AI revolution.

Understanding the SMH ETF

The SMH ETF provides investors with exposure to companies involved in the semiconductor industry, which is crucial for the development and deployment of advanced technologies like artificial intelligence.

Analyst Consensus and Price Targets

According to a unique ETF analyst consensus, which averages ratings on its holdings, SMH holds a 'Moderate Buy' rating. The Street's average price target for SMH is $388.58, which implies an upside of approximately 7% from current levels.

Several SMH holdings show particularly high upside potential. These include STMicroelectronics, Microchip Technologies, Synopsys, NXP Semiconductors, and Texas Instruments. Conversely, some holdings, such as Intel, Applied Materials, Teradyne, Micron, and Marvell Technology, are identified with the greatest downside potential by certain analyses.

Wall Street's Confidence in AI Chip Leaders

JPMorgan expects AI-related capital expenditures to keep rising through 2027. This is driven by major tech companies competing to develop new AI models and integrate AI tools across their core businesses. Nvidia is particularly poised to benefit from accelerating GPU (graphics processing unit) demand.

Broadcom and Marvell are well-positioned to meet the demand for custom AI processors. These are developed in collaboration with major players like Google, Meta Platforms, and Amazon. This strategic positioning underscores their importance in the evolving AI landscape.

- Nvidia: Expected to benefit from GPU demand.

- Broadcom: Strong position with custom AI processors for tech giants.

- Marvell Technology: Also well-positioned for custom AI processor demand.

- Advanced Micro Devices (AMD): Significant exposure to AI spending.

Broader Analyst Support

Other Wall Street brokerages share this optimistic view. Citi analysts, for instance, stated that the "AI party continues," which is good for AMD, Broadcom, Micron, and Nvidia. They noted that the higher capital expenditure outlook from Alphabet, Microsoft, and Meta Platforms supports their belief in strong AI spending.

Citi highlights specific exposure levels: AMD (19% of sales from AI), Broadcom (33% of sales), Micron (18% of sales), and Nvidia (a substantial 88% of sales). This deep integration into the AI supply chain positions these companies for continued growth.

Strong Buy Ratings

Wall Street currently maintains a 'Strong Buy' consensus rating on Nvidia, Broadcom, Micron, and Western Digital, with analysts seeing the highest upside potential in NVDA stock.

The continued and increasing investment in AI infrastructure by tech giants creates a robust demand environment for semiconductor and networking companies. This trend suggests a sustained period of growth for the sector, making it a key area for investors to watch.