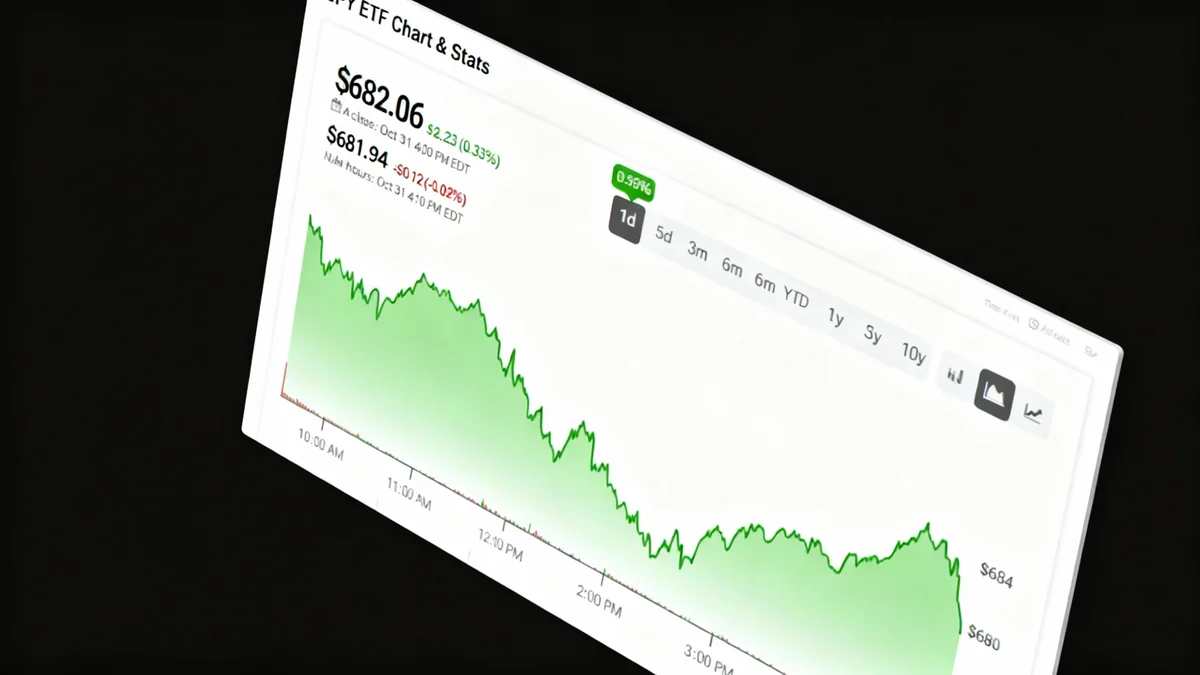

The SPDR S&P 500 ETF Trust (SPY) finished the week on a positive note, closing 0.32% higher on Friday. The advance was largely driven by a significant rally in Amazon shares following a strong earnings report and renewed optimism regarding a potential trade truce between the U.S. and China.

This upward movement reflects a broader trend in the market, with the S&P 500 Index (SPX), which SPY is designed to track, also ending the day up by 0.26%. The technology-focused Nasdaq 100 (NDX) saw an even more pronounced gain of 0.48%, underscoring the influence of major tech companies on current market sentiment.

Key Takeaways

- The SPY ETF gained 0.32%, supported by a nearly 10% surge in Amazon's stock price.

- Positive earnings reports from Amazon and Apple helped counter concerns from other tech giants like Meta and Microsoft.

- Investor sentiment appears mixed, with retail investors neutral while hedge funds increased their positions in SPY.

- Analysts maintain a 'Moderate Buy' consensus on SPY, with an average price target suggesting a 12.42% upside potential.

- Upcoming economic data, including the U.S. jobs report, and political developments could introduce market volatility.

Tech Earnings Provide Market Lift

The primary catalyst for Friday's market strength came from the technology sector. Amazon (AMZN) shares surged nearly 10% after the company reported impressive third-quarter results. Investors reacted positively to the robust growth in its cloud computing division, a key profit driver for the e-commerce giant.

Apple (AAPL) also contributed to the positive mood. The company's report showed strong revenue from its iPhone and services segments, reassuring investors of its continued market dominance. These strong performances were crucial in offsetting recent market anxieties stemming from high capital expenditure announcements related to artificial intelligence from Meta (META) and Microsoft (MSFT).

Sector Performance Snapshot

Within the SPY ETF's holdings, several sectors showed notable gains. The Consumer Discretionary, Energy, and Industrial sectors led the advance. In contrast, defensive sectors such as Consumer Staples, Utilities, and Materials experienced declines, indicating a slight shift in investor risk appetite for the day.

Investor Sentiment and Fund Flows

Recent capital movements provide a deeper look into investor behavior. Over the past five trading days, the SPY ETF recorded net inflows totaling approximately $3 billion. This indicates that, on balance, investors have been allocating new capital to the fund despite recent market choppiness.

However, sentiment is not uniform across all investor groups. Data suggests that retail investor sentiment remains largely neutral. In contrast, institutional players appear more bullish. Reports indicate that hedge fund managers increased their holdings of the SPY ETF during the last quarter, a signal of confidence from sophisticated investors.

Trading activity has been robust, with the fund's three-month average trading volume standing at 74.16 million shares. This high level of liquidity is one of the key attractions for investors using SPY for broad market exposure.

Understanding the SPY ETF

The SPDR S&P 500 ETF Trust is one of the largest and most popular exchange-traded funds in the world. Its primary objective is to replicate the performance of the S&P 500 Index, which comprises 500 of the largest publicly traded companies in the U.S. Because of its broad diversification, SPY is often used as a core holding in investment portfolios and as a barometer for the health of the U.S. stock market.

Analyst Outlook and Price Forecasts

Looking ahead, the analyst community maintains a cautiously optimistic stance on the SPY ETF. Based on a weighted average of analyst ratings for its individual holdings, the fund currently holds a 'Moderate Buy' consensus rating. This suggests that experts believe the constituent stocks have room for growth.

The average price target for SPY is pegged at $766.78. Achieving this target would represent an upside potential of 12.42% from its current levels. Furthermore, the fund's 'ETF Smart Score' is an eight out of ten, a proprietary metric that implies the ETF has a high likelihood of outperforming the broader market.

Holdings with High Potential

Analysis of SPY's underlying components reveals specific stocks that analysts believe have significant room to grow. The five holdings with the highest upside potential currently include:

- Loews (L)

- Fiserv (FI)

- Alexandria Real Estate Equities (ARE)

- Smurfit Westrock (SW)

- GoDaddy (GDDY)

Conversely, some holdings are viewed with more caution. The five stocks with the greatest potential downside include Palantir (PLTR), Paramount Skydance (PSKY), Intel (INTC), Tesla (TSLA), and Super Micro Computer (SMCI).

Navigating Future Volatility

While recent performance has been encouraging, several factors on the horizon could introduce volatility into the market. The ongoing U.S. government shutdown remains a point of concern for investors, with potential economic consequences the longer it persists.

Of more immediate importance is the upcoming U.S. jobs report for October, scheduled for release next week. This key economic indicator provides insight into the health of the labor market and heavily influences the Federal Reserve's decisions on interest rates. A report that is stronger or weaker than expected could trigger significant market reactions.

Investors will be closely watching these developments to gauge the market's direction and determine whether the recent strength powered by tech earnings can be sustained in the face of macroeconomic and political uncertainties.