The price of XRP has declined to $2.38, extending its weekly losses as broader market uncertainty and regulatory delays impact investor sentiment. The digital asset is facing pressure from ongoing US-China trade tensions and a prolonged government shutdown in the United States, which has stalled key decisions on cryptocurrency investment products.

Key Takeaways

- XRP's price dropped 1.31% in 24 hours to $2.38, underperforming the wider crypto market.

- A US government shutdown has delayed the Securities and Exchange Commission's (SEC) review of XRP spot exchange-traded funds (ETFs).

- Escalating US-China trade tensions are contributing to a risk-off sentiment across global markets, affecting digital assets.

- Analysts are monitoring the $2.16–$2.20 price range as a critical support level for XRP.

Macroeconomic Factors Create Headwinds

Global economic pressures are playing a significant role in the recent performance of digital assets, including XRP. Increased trade friction between the United States and China, involving tariff threats and potential software export restrictions, has prompted investors to move away from assets perceived as higher risk.

This shift has led to a broader risk-off move in financial markets. In the cryptocurrency space, this trend is reflected in the rising dominance of Bitcoin, which has climbed to 59.28%, its highest point since June 2025, as investors seek relative stability within the asset class.

What is a 'Risk-Off' Environment?

A "risk-off" environment describes a period in financial markets when investors collectively become more risk-averse. They tend to sell assets with higher perceived risk, such as stocks and cryptocurrencies, and move their capital into safer assets like government bonds or cash.

Government Shutdown Halts ETF Progress

A key factor directly impacting XRP is the ongoing US government shutdown, which has now lasted for 22 days. The shutdown has significantly reduced the operational capacity of the Securities and Exchange Commission (SEC), the primary regulator for investment products in the US.

As a result, the review and potential approval of several applications for XRP-spot ETFs have been frozen. These investment vehicles are seen as a critical gateway for attracting significant institutional capital into the XRP market. Without them, large-scale investment remains limited.

Market analysts now anticipate an additional delay of three to four weeks for any ETF decisions once the government fully reopens and the SEC addresses its backlog. Despite the procedural halt, projections from Bloomberg Intelligence suggest an 85% probability of an XRP ETF approval by the end of the year, though investor confidence remains subdued pending a resolution.

Technical Indicators Signal Caution

A closer look at XRP's technical chart reveals a bearish short-term outlook. The asset's price is currently trading below several key moving averages, which often act as indicators of market trend and momentum.

Current Technical Readings

- 10-day EMA: $2.4318

- 20-day EMA: $2.5338

- 50-day EMA: $2.7066

- 200-day EMA: $2.6121

With the price at $2.38, XRP remains below all these major trend lines, signaling that sellers currently have control of the market.

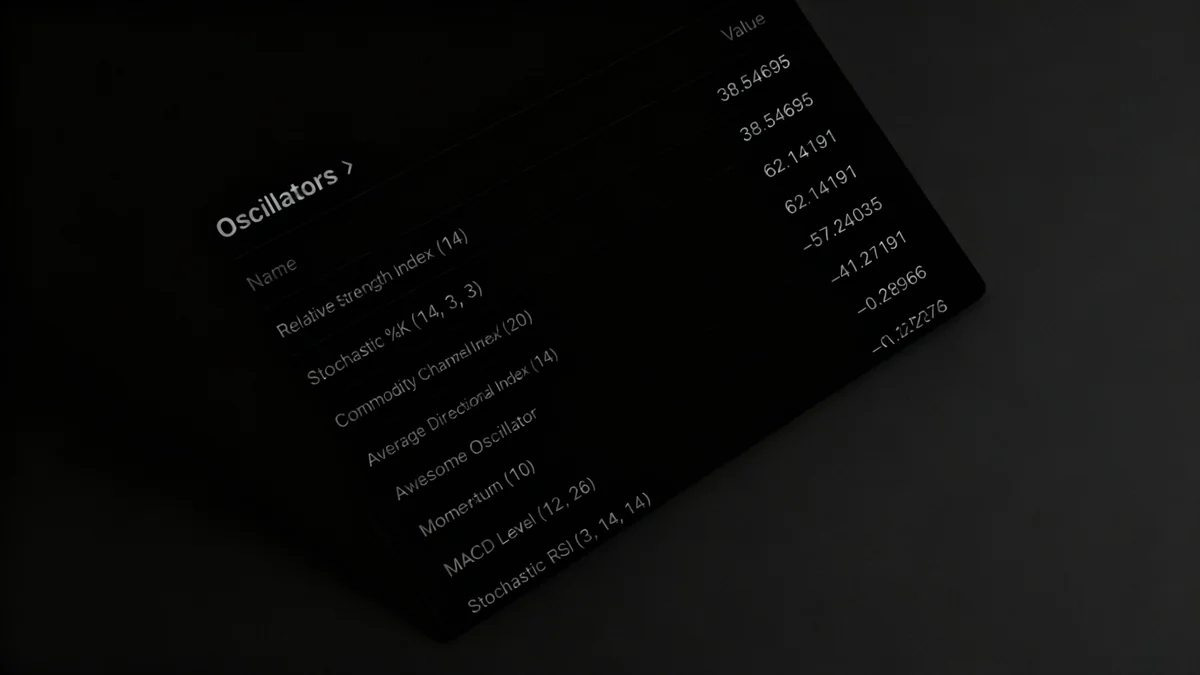

Other momentum indicators support this cautious view. The Relative Strength Index (RSI), a measure of price momentum, stands at 38.55, approaching what traders consider oversold territory but still neutral. Meanwhile, the MACD Level and Momentum indicators are both in negative territory, suggesting that buying pressure is weak and fading.

For market sentiment to improve, traders believe XRP needs to achieve a decisive close above the $2.64 resistance level. Until then, the path of least resistance appears to be downward or sideways.

Key Price Levels for Traders to Watch

In the current market, traders are closely watching specific price levels that could determine XRP's next major move. The most critical area of immediate support is identified in the range of $2.16 to $2.20. A sustained break below this zone could open the door to further declines, with potential targets at $1.94 and even $1.58.

"The $2.16–$2.20 support zone is crucial. Holding this level could provide a base for recovery, but a failure to do so may accelerate selling pressure."

On the upside, the first major hurdle is reclaiming the $2.50 level. A move above this price could neutralize the immediate bearish bias. However, a more significant recovery would require breaking past the primary resistance at $2.64 and the subsequent level at $2.77.

Despite the negative price action, on-chain data shows continued speculative interest. Open interest in XRP derivatives stands at $3.81 billion, and a recent inflow of $15.42 million on October 17 indicates that some traders are still positioning for future price movements. The overall outlook for XRP remains tied to progress on ETF approvals and an improvement in the broader macroeconomic climate.