The British pound showed notable resilience against the US dollar during recent trading sessions, briefly testing the 50-Day Exponential Moving Average (EMA). Despite a subsequent pullback, the GBP/USD currency pair continues to demonstrate relative strength compared to other major currencies facing a broadly stronger dollar.

This dynamic places the pair in a state of consolidation, where neither buyers nor sellers have gained decisive control. Traders are closely monitoring key technical levels to determine the market's next directional move.

Key Takeaways

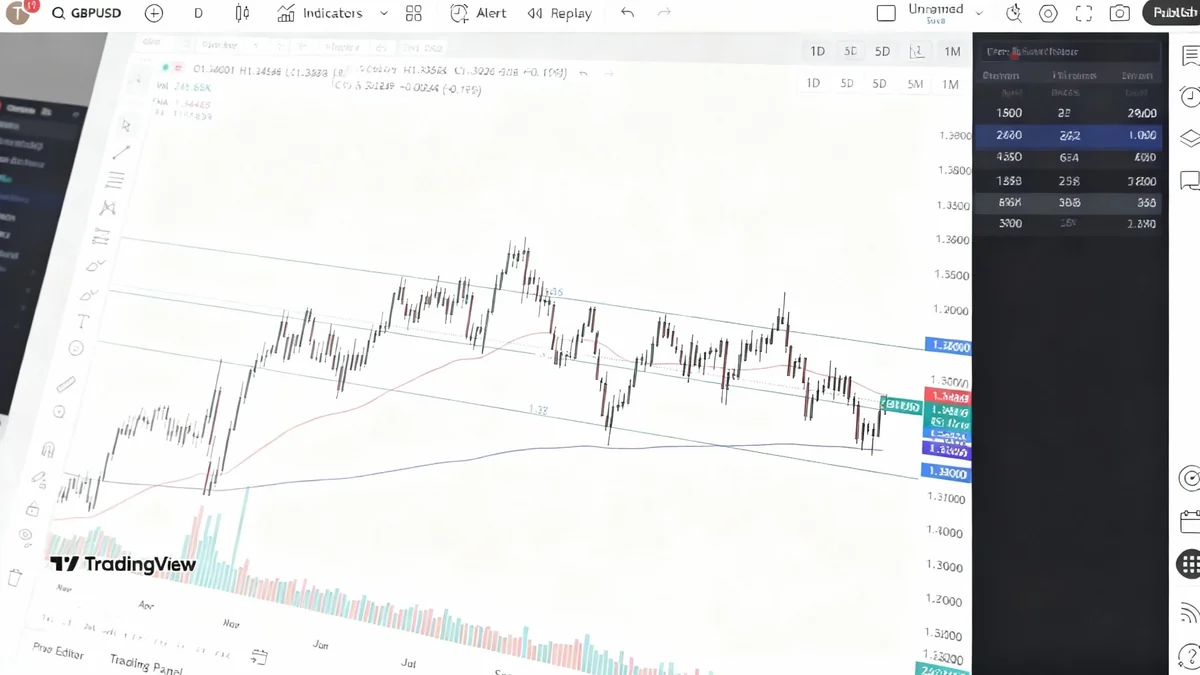

- Consolidation Range: The GBP/USD pair is currently trading within a defined range, with significant support near the 1.32 level and resistance around 1.36.

- Pivotal Midpoint: The 1.34 level is acting as a central pivot or "fair value" point, with price action frequently returning to this area.

- Key Indicators: The market is caught between two important technical indicators: the 50-Day EMA and the 200-Day EMA, which often signal market indecision.

- Relative Strength: The British pound has been stronger against the US dollar than many other currencies, such as the Euro or Canadian dollar, suggesting unique underlying support for the pound.

Technical Landscape for GBP/USD

The technical chart for the GBP/USD pair reveals a market in equilibrium. The price is currently positioned between two critical moving averages, which often act as dynamic support and resistance levels. This positioning suggests a period of indecision among market participants.

The Battle Between Moving Averages

The 50-Day Exponential Moving Average (EMA) is a key short-term trend indicator. The pound's recent attempt to break above this level was a significant event. A sustained move above the 50-Day EMA could signal renewed bullish momentum.

Conversely, the 200-Day EMA represents the long-term trend. This indicator is often watched by institutional investors to gauge the overall health of the market. As long as the price remains contained between these two averages, the market is considered to be in a sideways or range-bound phase.

What Are Moving Averages?

Moving averages smooth out price data to create a single flowing line, making it easier to identify the direction of the trend. The 50-Day EMA reflects the average price over the last 50 trading days, with more weight given to recent prices, while the 200-Day EMA reflects the longer-term 200-day trend.

Analyzing the Consolidation Range

For several weeks, the GBP/USD has been confined within a well-defined trading channel. Understanding the boundaries of this range is crucial for traders looking for potential opportunities.

Key Price Levels to Watch

The current market structure is defined by several important price points:

- The 1.36 Level (Resistance): This level has acted as a ceiling for the price. Multiple attempts to break above this area have failed, indicating the presence of significant selling pressure.

- The 1.34 Level (Midpoint): This area is the middle of the consolidation range. The market has treated this level as a gravitational point, suggesting it is currently perceived as the pair's "fair value."

- The 1.32 Level (Support): This level has served as a strong floor. Buyers have consistently stepped in around this price, preventing further declines.

As long as the price remains within this 1.32 to 1.36 channel, the market lacks a clear directional bias. A breakout in either direction would be a significant technical event.

The US Dollar's Broader Influence

While the British pound has its own economic drivers, the movement of the US dollar remains a dominant factor in the GBP/USD pair. The US dollar has shown strength against a basket of global currencies, driven by various macroeconomic factors.

Why is the US Dollar Strong?

Factors contributing to US dollar strength often include expectations of interest rate hikes by the U.S. Federal Reserve, safe-haven demand during times of global uncertainty, and positive economic data from the United States.

Despite the dollar's overall strength, the pound has held up better than many of its peers. This suggests that there are specific factors supporting the British currency, potentially related to the UK's economic outlook or monetary policy from the Bank of England.

"Even if the US dollar strengthens quite significantly, it will continue to struggle a bit against the British pound, due to the relative strength of this currency against many others out there," notes a market analyst. This highlights the pound's unique position in the current foreign exchange landscape.

This relative strength means that if the GBP/USD pair were to break down significantly, it would likely signal an even more severe decline for other currencies like the Euro (EUR) or the Canadian dollar (CAD) against the US dollar.

Potential Scenarios and Market Outlook

Given the current market conditions, traders are considering two primary scenarios. The lack of a clear trend makes range-trading strategies popular, but a breakout is always a possibility.

Scenario 1: Continued Range-Bound Trading

The most likely scenario in the short term is that the market continues to fluctuate within its established range. In this environment, traders might look for signs of exhaustion near the upper (1.36) or lower (1.32) boundaries.

Selling near resistance and buying near support could remain a viable strategy until a clear breakout occurs. The noisy, choppy price action supports this neutral outlook.

Scenario 2: A Decisive Breakout

A breakout could provide the next major directional clue. A sustained move above the 1.35 level and the 50-Day EMA could open the door for a test of the 1.36 resistance.

Conversely, a break below the 1.32 support level would be a bearish signal, potentially leading to a deeper correction. Such a move would likely coincide with a significant surge in broad-based US dollar strength across the market.

Ultimately, traders are advised to monitor the US dollar's performance against multiple currencies to get a comprehensive view of market sentiment. This wider context is essential for confirming any potential breakout in the GBP/USD pair.