Vanguard Executive Calls Bitcoin a 'Digital Toy'

A senior Vanguard executive has publicly described Bitcoin as a speculative asset, comparing it to a collectible toy, despite the firm allowing client access to crypto ETFs.

18 articles tagged

A senior Vanguard executive has publicly described Bitcoin as a speculative asset, comparing it to a collectible toy, despite the firm allowing client access to crypto ETFs.

Investors are showing a clear preference for broad market exposure over dividend strategies, with the Vanguard S&P 500 ETF (VOO) attracting $1 billion in...

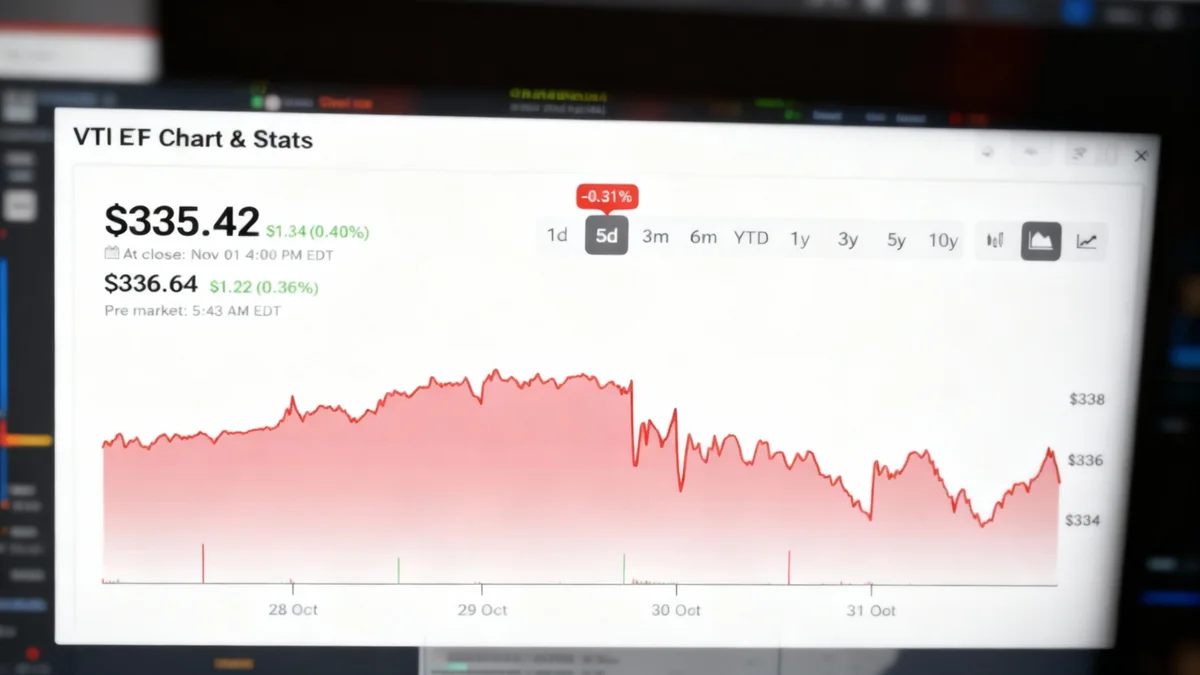

The Vanguard Total Stock Market ETF (VTI) has attracted $1 billion in net inflows over the past five days, signaling strong investor confidence.

Discover three distinct index ETFs that can form the foundation of a long-term investment portfolio, catering to goals from broad market tracking to growth and dividend income.

Investors can build a diversified, low-cost portfolio using a combination of three specific Vanguard ETFs: VOO for large-cap stability, VTWO for small-cap growth, and VDE for energy sector income.

The Vanguard Information Technology ETF (VGT) has posted a 23% year-to-date return, outpacing the S&P 500 by leveraging a heavy concentration in AI leaders.

With markets near all-time highs, a simple three-fund ETF strategy offers a path to build a diversified, low-cost portfolio for long-term growth and stability.

In a surprising turn, Vanguard's best-performing fund over the last five years wasn't a tech ETF, but its Energy ETF (VDE), which saw 30.2% annual returns.

The Vanguard Mega Cap Growth ETF (MGK) offers investors a low-cost, concentrated way to invest in the market's largest technology and growth stocks.

The Vanguard Growth ETF (VUG) offers investors heavy exposure to top tech firms, with nearly 40% of its $195 billion portfolio in Nvidia, Microsoft, Apple, and Amazon.

Investors can build a diversified portfolio using two key Vanguard ETFs: VOO for broad market growth and VYM for consistent dividend income and stability.

With the S&P 500 near all-time highs, investors are searching for value. Small-cap stocks and REITs present two overlooked areas with attractive valuations.